“Every dog has its day… or century or two”: The end of the remittance basis of taxation PART THREE

This is the third part in a 3-part series on "The End of the Remittance Basis of Taxation"

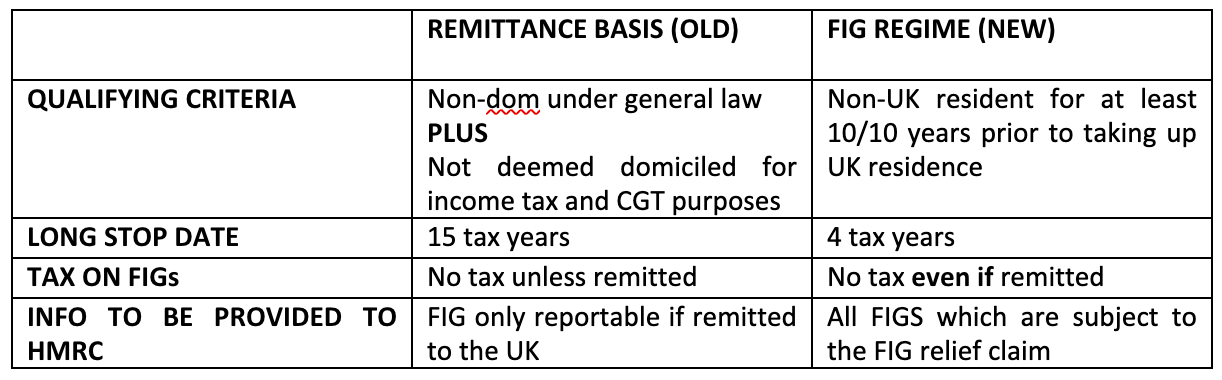

In a key, and positive, difference to the remittance basis, there is no separate charge on bringing those funds to the UK.

The FIG regime is also an ‘opt in’ one. A taxpayer needs to claim it. Further, it is possible to claim one year and not the next. As part of that claim, one must set out in the tax return all foreign income and gains which the taxpayer wants to fall within the FIG exemption.

Alas, making a claim does have some negatives. Firstly, the taxpayer will lose the ability to claim the personal allowance. Secondly, they will also lose the ability to benefit from the CGT annual exemption.

As well as choosing on an annual basis whether one wants to claim, you can also choose which items of foreign income and gains you want it to apply to. You might exclude some income from the exemption, for instance, if one’s position was better under a double tax agreement.

However, any claim will result in the loss of the personal allowance and annual exemption.

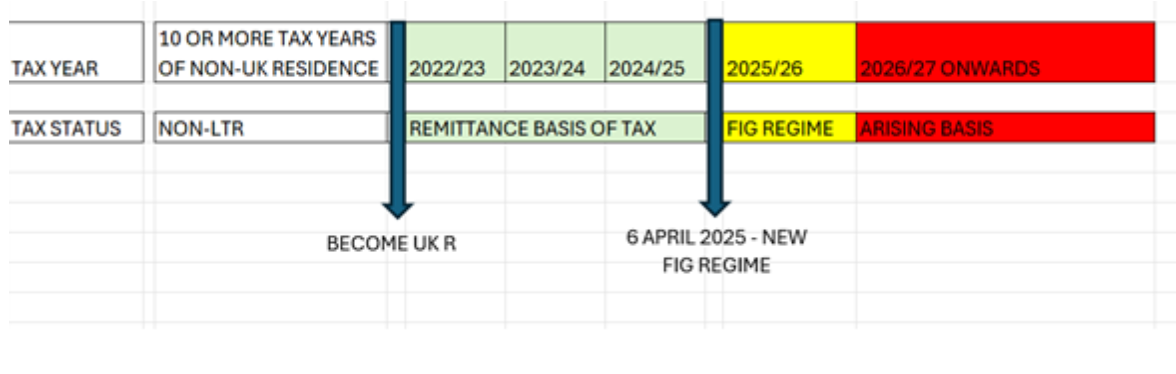

Comparison of FIG regime v remittance basis

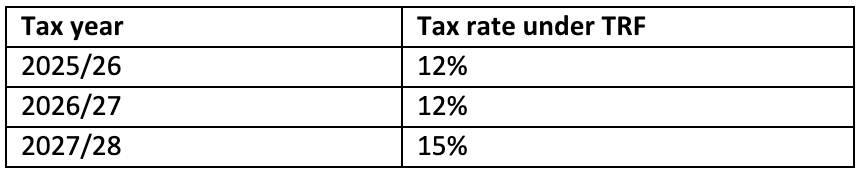

Temporary Repatriation Facility (“TRF”)

For taxpayers who have been remittance basis users in any tax year up to and including 2024/25, the TRF will be available.

The TRF allows those who have previously been remittance basis users to bring to the UK some of their foreign income and gains from previous years at a reduced rate of tax.

The tax rate is between 12-15% depending on the relevant tax year of the remittance.

The TRF requires the taxpayer to earmark certain funds or assets (“designated funds”) and pay the TRF charge.

Using the TRF is optional. One can use the existing remittance basis and pay tax under that regime if one prefers. This does not sound very sensible, however, as there is no credit given for foreign taxes under TRF, it might be that after foreign tax relief the normal remittance basis gives a better result.

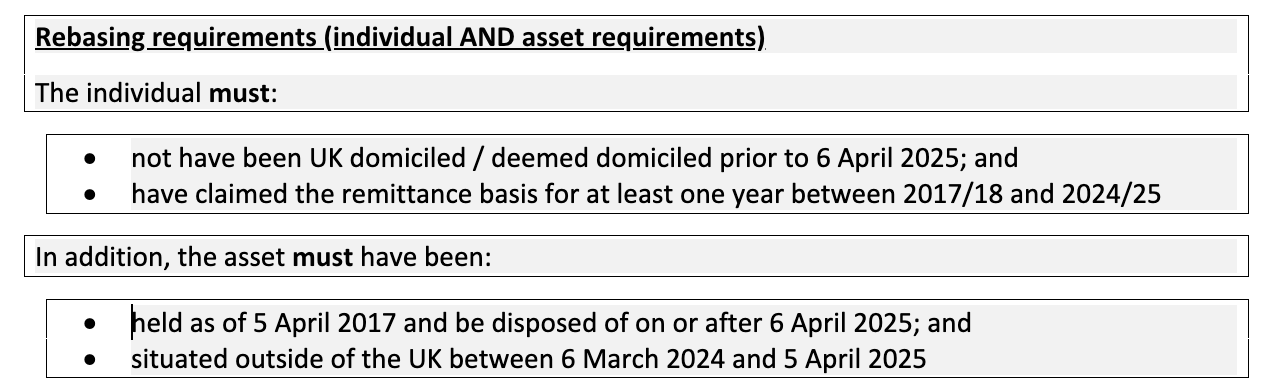

CGT Rebasing

CGT rebasing relief will apply for individuals who have claimed the remittance basis in previous years.

Where rebasing relief is available, it will allow the taxpayer to rebase personally held foreign assets. The relevant market value being 5 April 2017.

IHT

The tax changes also remove the sticky goo of domicile when it comes to determining one’s IHT exposure. This is because, not only do the changes abolish the remittance basis, but also break the nexus between domicile and tax more generally. This includes for IHT purposes which, until now, as had domicile as its main connecting factor.

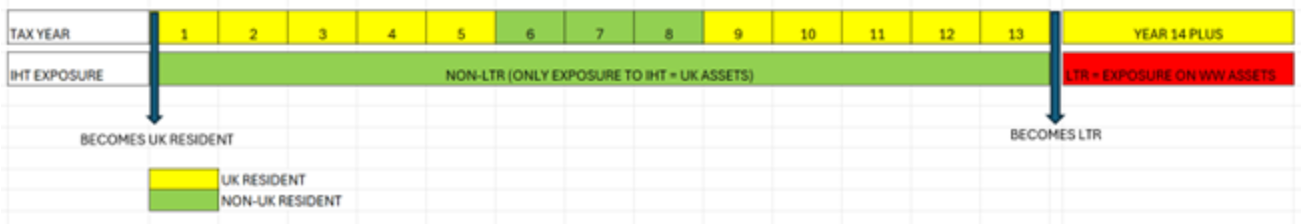

Going forward, from April 2025, the appropriate nexus will be whether the person is a “long term UK resident”. The world will therefore be divided as follows:

- A Long Term (UK) Resident (“LTR”): Subject to IHT on worldwide assets; and

- A Non-Long Term (“UK”) Resident (“Non-LTR”): UK assets only

As such, there are clear advantages of being Non-LTR.

Illustration - Becoming an LTR with gap of Non-UK residence in the middle

It should be noted that this will also apply to expats who have left the UK, as well as individuals coming to the UK.

Trusts

The previous position is set out above in some detail. But let’s quickly recap.

Trusts that were established by someone who was not domiciled under general law, and was not deemed domiciled for tax purposes, at the time the trust was established could benefit from ‘protected trust status’.

What does this mean?

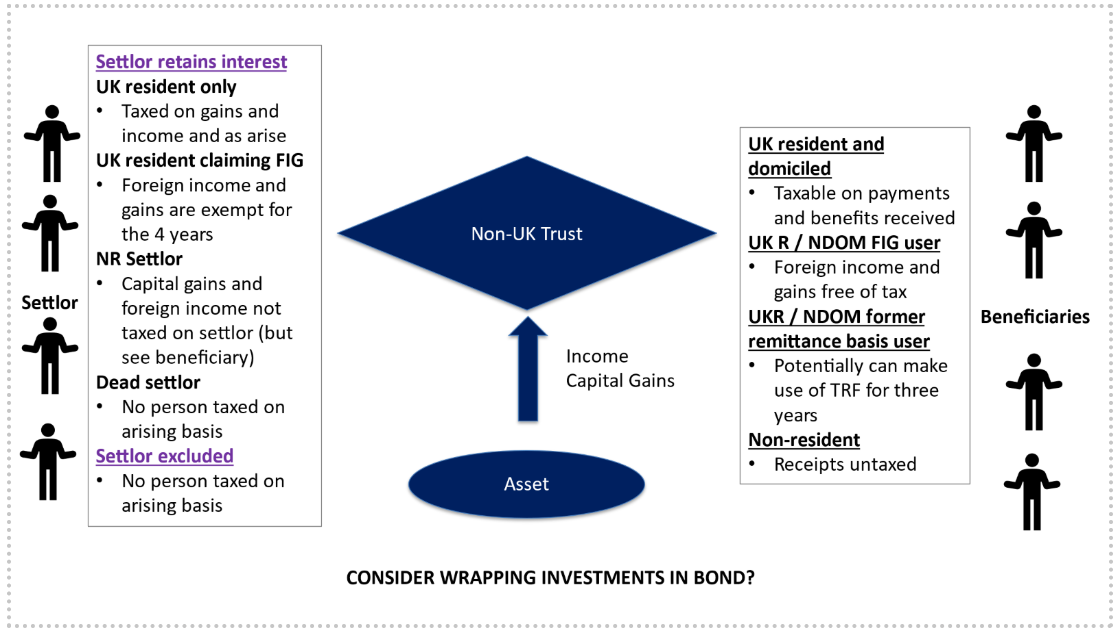

Well, it broadly means that foreign income and gains within the trust are not subject to tax on the settlor and will only be taxed when a payment of benefit is made to a discretionary. The precise tax position depending on who the beneficiary was.

However, the concept of a ‘protected trust’ is gone from 6 April 2025.

The 2025 trust changes - Income tax and CGT

As the protected trust regime has been swept aside, this means that settlors could now become taxable on trust income and gains from that date as they arise.

There are a couple of wrinkles to this position.

Firstly, this will only be relevant for trusts with UK resident settlors. If the settlor is non-UK resident then, for income and CGT purposes, the new rules will not bite. However, if they come to the UK then the position will change.

Secondly, a settlor might be able to avail themselves of the new FIG regime outlined above. Of course, this would only be a temporary reprieve from the new trust rules.

In addition, the settlor might have died. This is a bit of a thin silver lining, but such trusts will not be caught as a result.

Finally, a settlor might exclude themselves from being able to benefit. Of course, this is something that might not square with the original reasons for setting up a trust.

Summary 2025 trust changes for income tax and CGT

- Protected trust rules gone = potential for settlor to be taxed on income and gains as arise

- UK resident settlors who can’t / don’t claim 4-year FIG regime: In principle, taxable on an arising basis depending on the trust provisions (is the settlor excluded?) and the investments held by the trusts

- UK resident settlors who claim the new 4-year FIG regime (discussed below): No affect, but only whilst the claim is in place.

- Non-resident settlors: unaffected

- Beneficiaries claiming FIG: Someone claiming the 4-year FIG regime can receive distributions from a non-UK trust free of UK income tax and CGT.

The affects of the changes might also be mitigated by the types of investments held by the trustees. For instance, if the trustees hold income and gains producing assets via an insurance wrapper then these should not be attributed to the settlor. There will be a roll up within the wrapper.

The way that beneficiaries of non-UK trusts are taxed will not change much from that described in the earlier sections of this article, subject to the following points.

Firstly, beneficiaries who have just come to the UK will be able to claim the 4-year FIG regime can receive distributions from a non-UK trust free of UK income tax and CGT.

Additionally, where beneficiaries have been in the UK for a longer period, and were previously relying on the remittance basis, they may be able to use the Temporary Repatriation Facility for 2025/26-2027/28 inclusive to reduce the tax.

A cut out and keep guide to the new non-UK trust rules

IHT

This is an area of change where the bite is very much worse than the bark. It ain’t no Chihuahua. Indeed, these are the changes that will seriously have made non-doms think about whether they can conduct their UK affairs from a different jurisdiction.

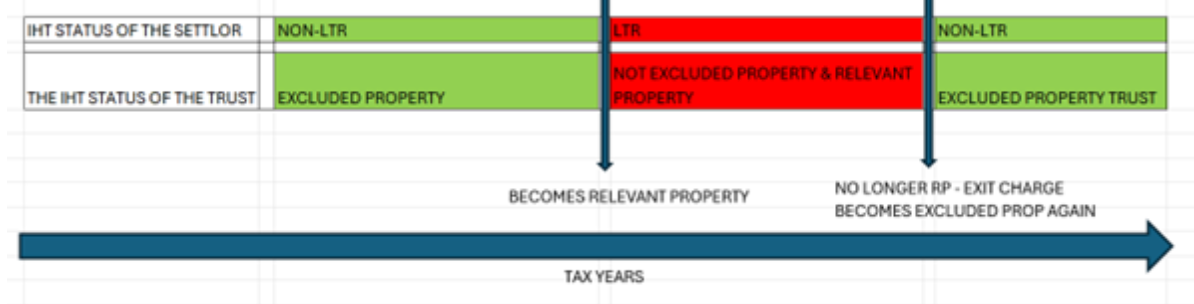

Under the current rules, trusts established by non-domiciled individuals benefit from the excluded property regime – a broad, beneficial IHT status that applies to non-UK assets held by the trustees;

Under the new rules, the settlor must be a Non-LTR at any relevant time for the trust to benefit from excluded property status.

In other words, the IHT status of the trust is not set in stone at the outset – it is built on shifting sands.

This means that the IHT status of a trust will be more fluid, moving in and out of the relevant property / excluded property regime – notably, when it leaves the relevant property (“RP”) regime then it will be subject to an IHT exit charge.

In addition, one should not forget that Relevant Property is also subject to a ten-year charge. This runs from the date the trust was established – and not from the date the status of the trust changed as a result of the new rules! As such, planning for clients AND trustees is important.

It should be noted that the status of the trust is ‘locked in’ at only one point. That is the death of the settlor. On death of the settlor, the trust’s ongoing status will reflect the settlor’s status at death.

The final point to be made is around the Gift With Reservation of Benefit (“GWROB”) Rules.

Historically, the excluded property status of these trusts has ‘trumped’ the GWROB rules. This meant that the settlor could retain an interest in the trust assets.

For trusts established before the Budget (on or before 29 October 2024) and where no funds have been added, things will remain the same.

However, for new trusts, they will fall fairly and squarely in the GWROB rules.

Dachshund and blast!

IHT and Trusts – 2025 rules

Trusts already in existence at 30 October 2024 (and no more funds added): When settlor becomes LTR in RP regime but not Gift with Reservation of Benefit (“GWROB”) provisions

Trusts established and created after 30 October 2024: In both RP and GWROB regimes.

Trusts with Non-LTR settlors under new rules: Excluded property trust in relation to non-UK assets

WON’T SOMEBODY THINK OF THE EXPATS?

These changes potentially present a boon for expats. I cover these in a separate article [LINK].

CONCLUSION

So, what do we think of these changes?

Are they Border Collie-ring on the genius… or are we heading for dog days?

Objectively, there must be benefits in removing ‘domicile’ from being a primary connector for tax purposes. Indeed, residence is a far more objective test when it comes to setting out the scope of a tax charge so, in principle, this is a good thing.

But that’s the only bone this tax policy dog is getting thrown in this article!

Replacing the remittance basis regime with the FIG regime is, of course, better than nothing. But, when compared with other regimes around the world, the FIG regime is hardly going to get Pavlov’s dog’s a-slobbering in the corner.

On top of this, the changes to trusts are rabidly bad. This will certainly send the non-doms racing out of the traps to the departure gates like whippets. Really bad tax and economic policy.

So, in short, having Cavapoochon the light on these changes, what is my verdict?

It’s pretty Shih Tzu, to be honest.

If you have any queries about this article or want to speak to a Tax Advisor then please get in touch.

Mosaic Chambers Group is a trading style of Mosaic Chambers FZ LLC

BUSINESS CENTER 05,

RAKEZ BUSINESS ZONE FZ

Email us

info@mosaicchambers.com

All Rights Reserved | Mosaic Chambers Group LLC | Privacy Policy